-

4+ hours of on-demand video

Absolutely NO boring PowerPoints. Instead, we talk to you face-to-face (like our YouTube videos). Keeping you engaged all 21 modules (4+ hours).

-

Your own investment plan

In this course, we share our specific holdings in our investment accounts and we include a 19-page pdf investment plan for you to download and fill out, so that you can create your own individual investment plan, too!

-

30+ investing resources

Our resources include homework assignments, summary notes, and a list of additional resources that include additional investing tips that you can print and take with you anywhere

What You’ll Learn:

This course consists of more than four hours of video instruction, more than thirty resources, and a 19-page downloadable pdf investment plan for you to fill out and create based on the information you learn from the course.

The video instruction is broken into twenty-one modules. Each module focuses on different investing topics, with the modules presented in sequential order.

We begin the course by discussing the steps you should take before you begin investing. We also discuss how to calculate your FIRE number and how that number relates to your overall investment portfolio and your withdrawal strategy during retirement. We then share stock market history information, historical market perspectives, and the mentality behind investing.

We go over the different types of investment accounts that may be available to you (including tax-advantaged and non-tax advantaged accounts) and we discuss the various types of fees associated with different types of investments. We discuss the key characteristics to look for when picking a brokerage company and we walk you through how to open a brokerage account, how to fund the account, and how to set the account up for automatic investments.

We discuss how to structure your order of investing and the different types of investments that you can add to your portfolio (including index funds, ETFs, REITs, individual stocks, and bonds). We discuss the key factors you need to consider when deciding on your asset allocation. We walk you through how to research different types of investments and what to look for when you’re investing in different assets, such as index funds, ETFs, REITs, and individual stocks.

We discuss whether you should lump sum your money into your investments or whether you should dollar cost averaging. We also discuss how to rebalance your portfolio, common investing mistakes to avoid, and how to invest during a recession and bear markets.

At the end of the course, we put everything together so that you can take action and invest.

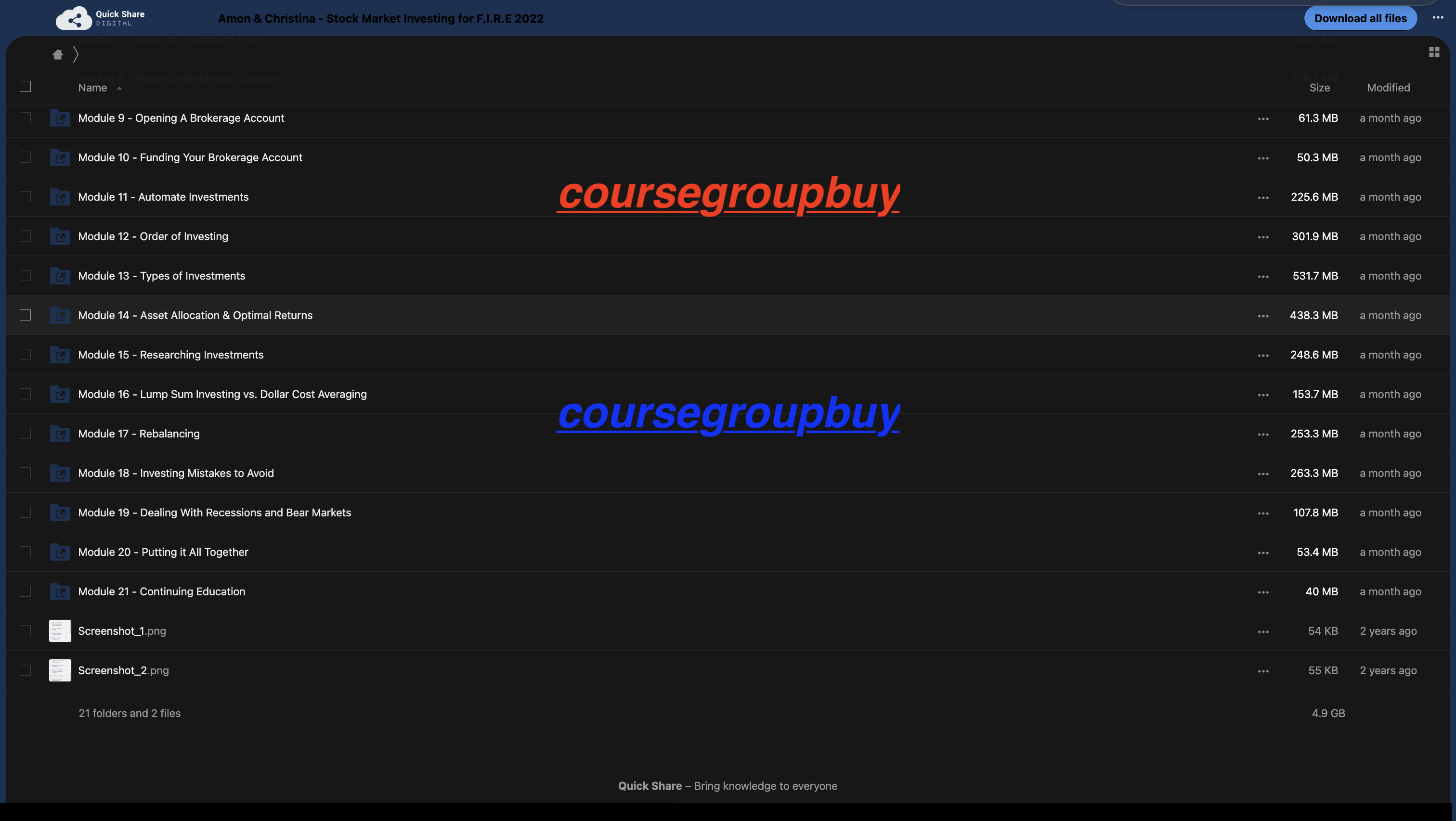

Course curriculum:

1. Module 1 – Introduction & Overview

• Welcome!

• Download Your Stock Market Investing Plan for FIRE!

• Module 1 Assignment: Section I of Your Investment Plan

• Access the Private Facebook Group

2. Module 2 – Steps to Take Before You Begin Investing

• Establishing an Emergency Fund

• Pay off High Interest Debt

• Module 2: Summary Notes

3. Module 3 – Starting With a Goal & Achieving FIRE

• Calculating Your FIRE Number

• The Trinity Study

• Module 3: Summary Notes

• Module 3 Assignment: Start With a Goal

4. Module 4 – Stock Market History (Good Investors Know Their History)

• How it All Began

• Crash of 1929 (Black Tuesday)

• Crash of 1973-74 (Oil Crisis Crash)

• Crash of 1987 (Black Monday)

• Crash of 2000 (Dot-com Bubble)

• Crash of 2008 (Great Recession)

• Crash of 2020 (Coronavirus Crash)

• Module 4: Summary Notes

5. Module 5 – Investing Mentality

• Controlling Your Emotions

• vHow to Behave During a Crash

• Module 5: Summary Notes

• Module 5 Assignment: Investing Assessment

6. Module 6 – Overview of Investment Accounts

• Two Types of Accounts: Tax Advantage & Non-Tax Advantage

• Tax Advantaged Accounts – 401(k)

• Tax Advantaged Accounts – Solo 401(k)

• Tax Advantaged Accounts – 457 Plan

• Tax Advantaged Accounts – 403(b)

• Tax Advantaged Accounts – Traditional IRA

• Tax Advantaged Accounts – Roth IRA

• Tax Advantaged Accounts – Self-Directed IRA

• Tax Advantaged Accounts – Health Savings Account (HSA)

• Tax Advantaged Accounts – 529 Plans

• Non-Tax Advantaged Accounts – Ordinary Brokerage Account

• Module 6: Summary Notes

• Module 6: Additional Resources

7. Module 7 – Types of Investment Fees

• Brokerage Fees

• Transaction Fees

• Expense Ratios

• Front-End Load Fees

• Back-End Load Fees

• Management Fees

• Annual Fees

• Impact of Fees

• Avoiding or Reducing Fees (Tip 1)

• Avoiding or Reducing Fees (Tip 2)

• Avoiding or Reducing Fees (Tip 3)

• Avoiding or Reducing Fees (Tip 4)

• Module 7: Summary Notes

8. Module 8 – Picking a Brokerage Company

• Evaluating the Broker’s Security

• Insurance – What to Look For?

• Consider the Brokerages Fraud Policies

• Checking for Fees

• Assessing Customer Service

• Platform Interface (Website and App)

• Types of Accounts Offered

• Customer Reviews

• Module 8: Summary Notes

9. Module 9 – Opening A Brokerage Account

• Step-by-Step Instructions

• Module 9: Summary Notes

10. Module 10 – Funding Your Brokerage Account

• Options for Funding Your Account

• Module 10: Summary Notes

11. Module 11 – Automate Investments

• Automating – Benefit 1

• Automating – Benefit 2

• Automating – Benefit 3

• Automating – Benefit 4

• Setting Up Automated Investments

• Module 11: Summary Notes

12. Module 12 – Order of Investing

• Why Order of Investing Matters

• Step 1

• Step 2

• Step 3

• Step 4

• Step 5

• Step 6

• Step 7

• Bonus Step for Early Retirees

• Module 12: Summary Notes

• Module 12 Assignment: Your Order of Investing

• Our Investment Plan/How We Invested for F.I.R.E. (Plus Bonus Asset Tracker with our up to date investments)

13. Module 13 – Types of Investments

• Actively Managed Mutual Funds

• Index Funds

• Deciding Between Mutual Funds & Index Funds

• Mutual Funds vs. Index Funds – Goals & Fees

• Mutual Funds vs. Index Funds – Comparing Performance

• Index Fund Preference

• Exchange Traded Funds

• Comparison – ETFs and Index Funds

• Why People Choose ETFs Over Index Funds – Reason #1

• Why People Choose ETFs Over Index Funds – Reason #2

• Why People Choose ETFs Over Index Funds – Reason #3

• Why People Choose Index Funds Over ETFs – Reason #1

• Why People Choose Index Funds Over ETFs – Reason #2

• REITs

• Individual Stocks

• Bonds

• Module 13: Summary Notes

14. Module 14 – Asset Allocation & Optimal Returns

• What Is Asset Allocation

• Asset Allocation and Time Horizon

• Aggressive vs. Reckless Investing

• Role of Bonds

• Stock vs. Bond Allocation

• Problem With the Rule of Thumb

• Our Thoughts When Developing Our Portfolio Allocation

• Asset Allocation and Revisiting the Trinity Study

• Our Portfolio – Stocks Bonds and Emergency Funds

• Our Portfolio – Creating Our Core Investment

• Our Portfolio – Supporting Our Core Investment With ETFs

• Our Portfolio – Supporting Our Core Investment With REITs

• Our Portfolio – Supporting Our Core Investment With Individual Stocks

• Module 14: Summary Notes

• Module 14 Assignment: Your Targeted Asset Allocation

• Module 14: Additional Resources

15. Module 15 – Researching Investments

• Researching Investments in General

• Researching Index Funds

• Comparing Index Funds

• Researching and Comparing ETFs

• Researching and Comparing REITs

• Individual Stocks A Word of Warning

• Researching and Picking Stocks – Factor 1

• Researching and Picking Stocks – Factor 2

• Researching and Picking Stocks – Factor 3

• Researching and Picking Stocks – Factor 4

• Researching and Picking Stocks – Factor 5

• Researching and Picking Stocks – Factor 6

• Researching and Picking Stocks – Factor 7

• Module 15: Summary Notes

• Module 15 Assignment: Your Investments

16. Module 16 – Lump Sum Investing vs. Dollar Cost Averaging

• An Identified Lump Sum

• Vanguard Study and Results

• The Mindset Role

• Taking Into Account the Fear of Investing

• The Ultimate Question to Ask Yourself

• Module 16: Summary Notes

• Module 16: Additional Resources

17. Module 17 – Rebalancing

• Strategy of Rebalancing

• Sample Portfolio to Rebalance

• Rebalancing Strategy #1

• Rebalancing to Reduce Risk

• Rebalancing to Increase Returns

• Rebalancing Strategy #2

• Rebalancing vs. Timing the Market

• Rebalancing Frequency Option #1

• Rebalancing Frequency Option #2

• Module 17: Summary Notes

• Module 17 Assignment: Rebalancing Strategy

18. Module 18 – Investing Mistakes to Avoid

• Eight Mistakes – Your Guiding Light

• Mistake #1

• Mistake #2

• Mistake #3

• Mistake #4

• Mistake #5

• Mistake #6

• Mistake #8

• Mistake #7

• Module 18: Summary Notes

• Module 18 Assignment: Note to Self – Investment Mistakes to Avoid

19. Module 19 – Dealing With Recessions and Bear Markets

• Tip 1

• Tip 2

• Tip 3

• Tip 4

• Module 19: Summary Notes

• Module 19 Assignment: Your Stock Market Crash Plan

20. Module 20 – Putting it All Together

• Putting It All Together

• Module 20: Summary Notes

21. Module 21 – Continuing Education

• Continuing Education

• Module 21: Summary Notes

• Module 21 Assignment: Other Considerations

Reviews

There are no reviews yet.